How WA State Democrat Property Tax Increases, Harm Families

Educate. Advocate. Mitigate. Activate!

A big thank you to David Spring, M.Ed. and the Washington Parents Network for helping to expose two Democrat-sponsored bills likely to pass in the 2025 WA state legislature, that proponents falsely claim are needed to “fund schools.”

These bills are likely to drive property taxes so high that they could lead to a “Taxpayer Revolt,” which will cause local school levies to fail, thereby reducing school funding!

These bills continue ridiculous “out-of-control” spending for all kinds of crazy Democrat scams, like funding laser hair removal and expensive drug cocktails for transgender inmates in our state prisons.

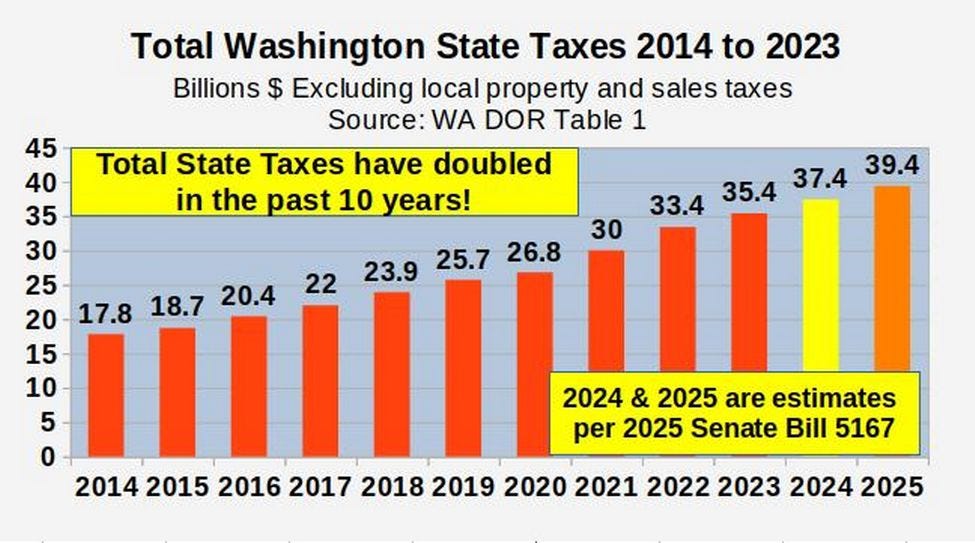

Here is a graph of total state taxes from 2014 to 2023 based on Washington State Department of Revenue data:

The above graph includes the state portion of our property taxes and the state portion of sales taxes and business taxes, but excludes local property taxes and sales taxes. It also excludes gas taxes. State taxes rose from 18 billion in 2014 to over 36 billion in 2024. This doubling in state taxes occurred despite a 1% cap on increasing property taxes during the past 10 years.

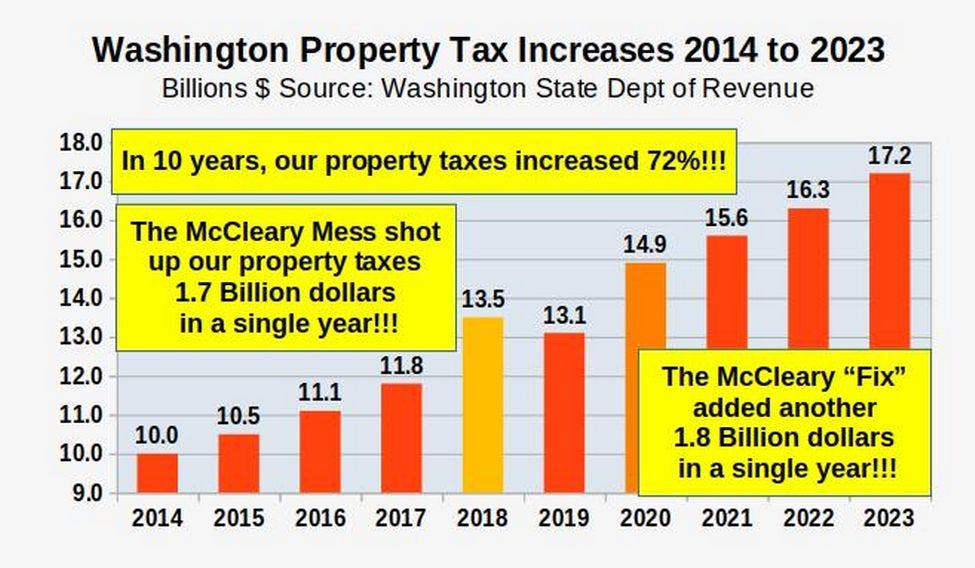

Below is a graph showing that property taxes have increased by 72% during the past 10 years!

Under Democratic leadership, property taxes shot up from $10 billion in 2014 to $17.2 billion in 2023 – a 72% increase in just 10 years. Because of the McCleary School Funding Mess (also known as the McCleary Levy swipe because it robbed over a billion dollars in local levy funds in 2018 and moved them to the state levy fund), there was a $1.7 billion property tax increase in 2018 and another $1.8 billion property tax increase in 2020.

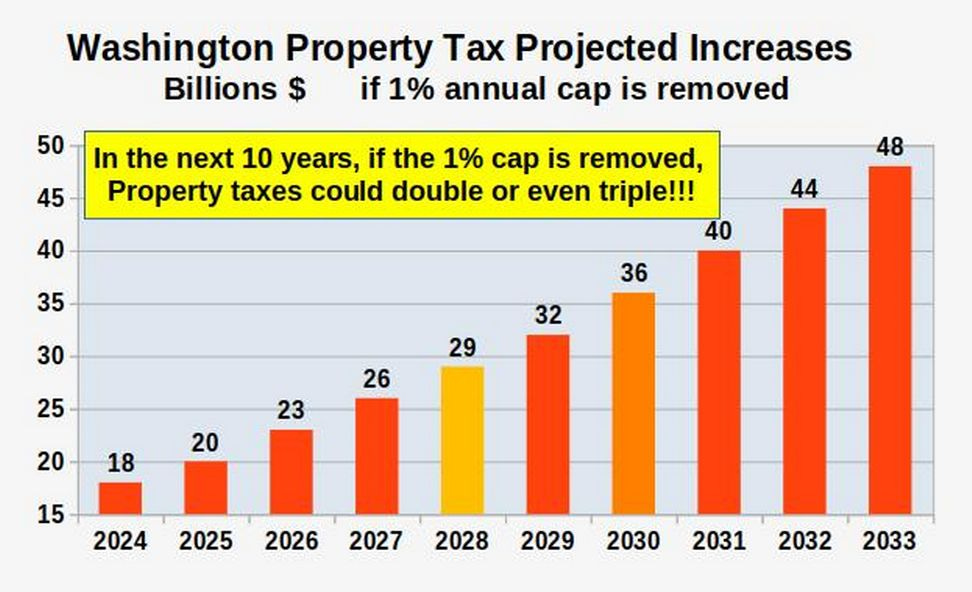

SB 5798 is an insane bill that will remove this 1% limit and allow almost unlimited increases in state taxes. Instead of merely doubling in the next 10 years, our property taxes could triple!

The bill not only allows dramatic increases in state property taxes, but it also allows massive increases in county, city, and local property taxes – all without a vote of the people. There is NO LIMIT to how much your taxes can be raised if the taxing agency declares a "substantial need" for public safety, criminal justice, and community protection services. This bill is a “blank check” to almost anyone who wants to raise taxes for virtually any reason, all without a vote of the people who will be forced to pay these taxes!

The good news is that 45,175 people - A RECORD NUMBER - signed in to oppose this bill, and only a few dozen signed in to support. This was by far the highest number of people to EVER oppose ANY bill in WA State History!

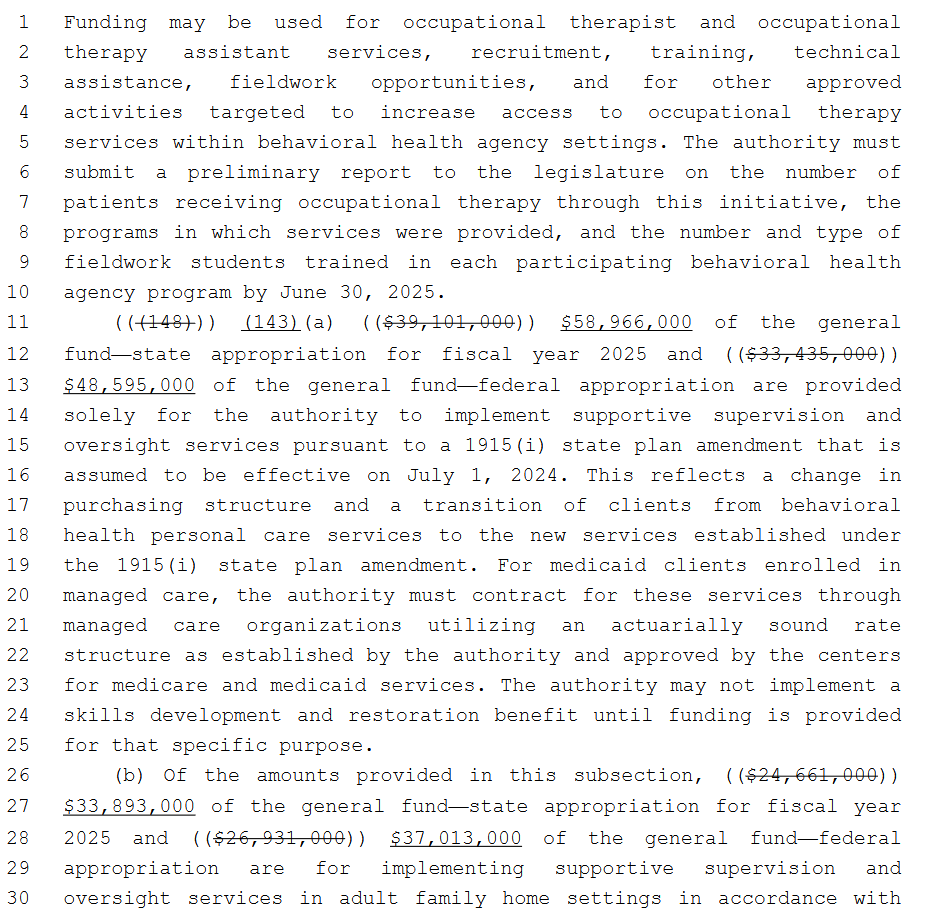

The other bill to oppose is ESSB 5167, the 2025-2027 two-year operating budget. Notice 3/31/25 Democrat Striker Amendment - Only 1,317 pages! OF NOTE PAGE PAGE 928 - Line 11 increasing costs $39,101,000 to $58,966,000 and line 12 & 13 increasing $33,435,000 to $48, 595,000 - Hmm… No public Hearing - This is against the State Constitution! How is this ok?

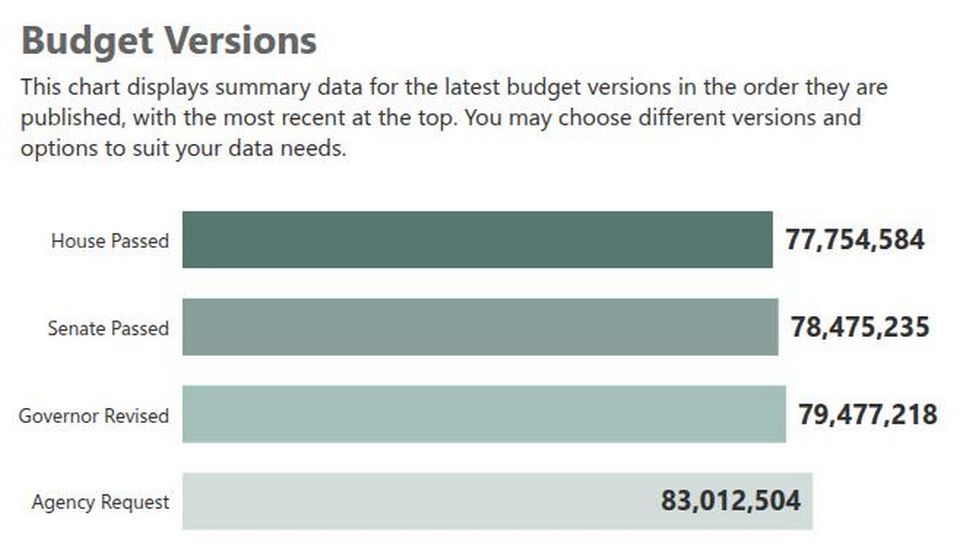

There are two versions of this bill; one was passed in the Senate, and a slightly different version was passed in the House. Both are for about $78 billion, which is $39 billion per year:

Both versions are slightly less than the $40 billion per year budget that Ferguson wanted or the $41 billion budget that state agencies wanted. But both versions are still dramatically more than the previous Washington State budget for 2023-2025, which was about $36 billion a year or $72 billion per biennium.

On April 3, 2025, the Senate rejected the House version of ESSB 5167. A conference committee was set up to resolve the minor differences between these bills. But regardless of what is decided, the result will be $39 billion per year—the highest budget in state history.

Sadly, these colossal property tax increases will drive up monthly rental costs and force many families out of their homes! Our state is already one of the least affordable states in which to live. Whether families rent or own their home, the last thing families need is a huge increase in state taxes.

SO WHAT IS THE SOLUTION??? VOTE DEMOCRATS OUT OF OFFICE!

Also, how can schools be funded without driving families out of their homes? The solution to the ever-worsening property tax increase nightmare is to follow three basic principles set forth in our Washington State Constitution.

Step 1: Reduce the Size of State Government

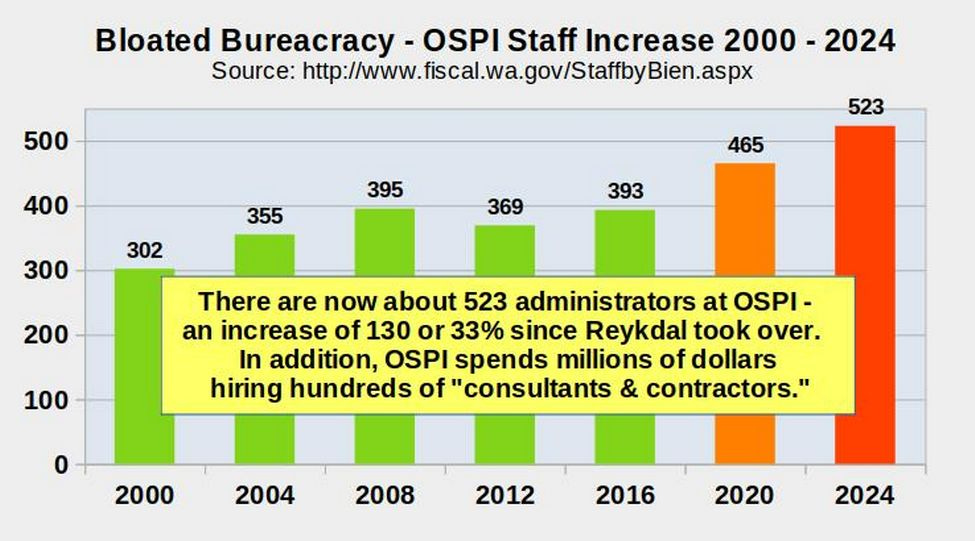

Just as our national government has grown to be extremely bloated, so has the government in Washington state. Since he took office in 2017, Reykdal has added more than 130 paper-pushing bureaucrats to his OSPI office in Olympia.

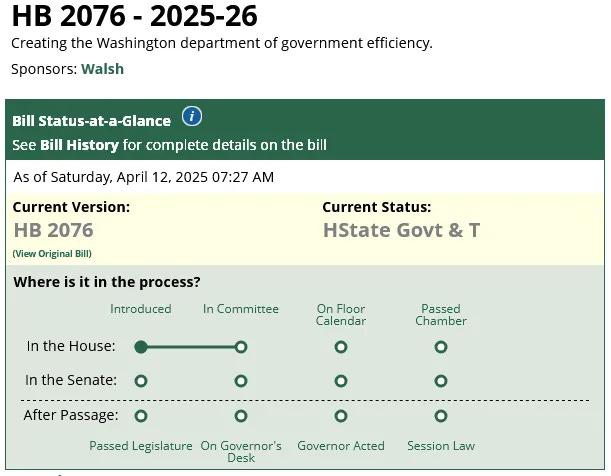

A big thank you to Washington State Representative and WAGOP Chair Jim Walsh for sponsoring and introducing HB 2076, potential legislation to be heard in the 2026 legislative session that would create a WA State Department of Government Efficiency (DOGE). This is a good start, and would be an excellent tool for rooting out bureaucratic bloat and waste in state government.

The goal should be to reduce every state agency by at least 33%, back to what it was in 2016. This would allow us to save more than 10 billion dollars a year and roll back property taxes to what they were in 2016!

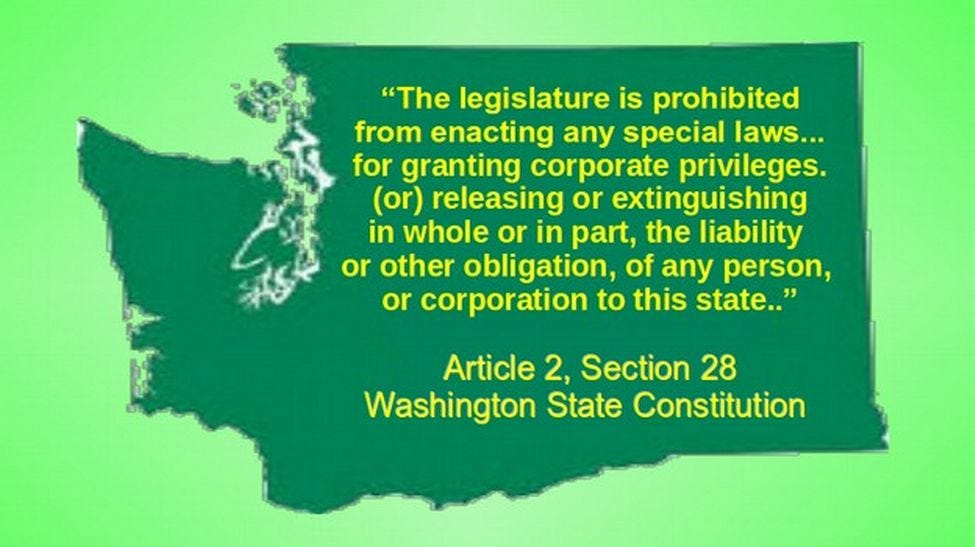

Second - Eliminate billions of dollars in illegal tax breaks to trillion-dollar corporations like Microsoft, Boeing, and Amazon. Article VII, Section 2 of the Washington State Constitution requires a uniform tax structure, and Article II, Section 28 prohibits giving special tax breaks to any corporation for any reason.

These corporations should pay their fair share of state taxes, just like every other business. Paying state taxes would not affect any of these corporations because they can deduct their state taxes from their federal taxes.

Third, we need to restore a property tax break that is allowed by our State Constitution, which is the Homestead Exemption for Retired Persons. Article VII, Section 10 states: “The following tax exemption shall be allowed as to real property: The legislature shall have the power, by appropriate legislation, to grant to retired property owners relief from the property tax on the real property occupied as a residence by those owners.”

Many retired people are forced to sell their homes because they live on a fixed income and can’t afford the ever-increasing property taxes. The median home value in Washington state is $600,000 and is increasing rapidly. This is 50% higher than the national average home value, which is about $400,000.

We could begin by exempting the first $400,000 of home value for any retired person over the age of 65, and eventually exempt the first $600,000 of home value for any retired person over the age of 65.

Reducing Property Taxes Helps Families With Children:

The current property tax rate in Washington state is over 1%, meaning that the average family faces a property tax bill of at least $6,000 per year or $500 per month. If we can roll this property tax bill back to under $3,000 per year (about what it was 20 years ago), we can save the average family $250 a month.

Many studies have shown that one of the best ways to maintain childhood mental health is to provide children with a stable home and community environment. Instead of driving families out of their homes with excessive property tax increases, we should help them stay in their homes by significantly reducing their property taxes.

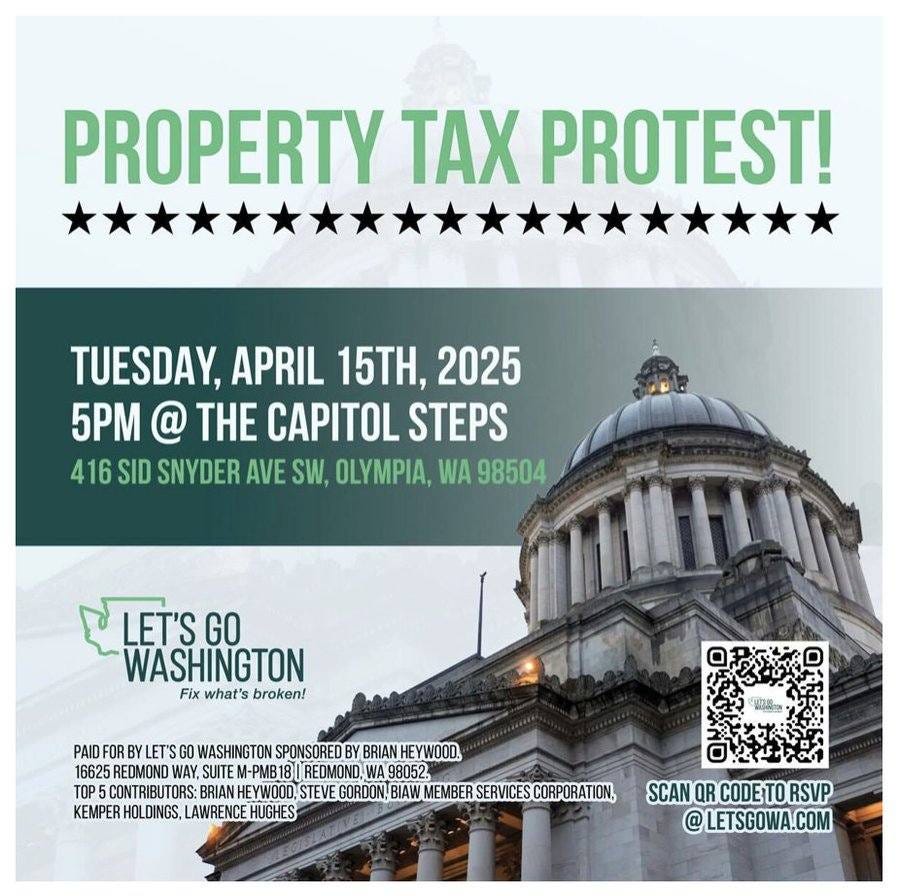

IMPORTANT: There no better way to mark Tax Day than protesting these slew of Democrat taxes, including HB 2049 that would raise the cap on property taxes from 1% to 3%. Property taxes are already way too high, but radical Democrat lawmakers are trying to gouge us at every turn with the largest tax package in state history. Oppose HB 2049! Make Your Voice Heard - Tuesday, April 15, 2025, at 5 PM @ The Capitol Steps - 416 Sid Snyder Ave SW, Olympia.

Bill Bruch

Bill Bruch is the WA State GOP Election Integrity Committee Chairman (5th year), WAGOP Executive Board Member (5th Year), Skagit County GOP Chairman (9th year), Citizen Journalist, Blogger, Business Owner, 2020 WA State House Representative Candidate, Former Council Member, and WA State 2016 and 2024 RNC National Convention Delegate.